Embarking on the cancellation of an insurance policy requires a formal approach, and a well-crafted insurance cancellation letter is the professional way to initiate the process. This template is designed to guide you through creating a clear and effective cancellation request, ensuring that your insurance provider receives all the necessary information to process your decision without delay. With the right template, you can confidently navigate through the specifics of policy termination, ensuring a smooth and hassle-free resolution to your insurance needs. Whether you’re moving to a new provider or adjusting your coverage, this Sample Insurance Cancellation Letter Template is an essential tool for communicating your intentions clearly and securing a prompt response from your insurer.

sample insurance cancellation letter template" width="390" height="367" />

sample insurance cancellation letter template" width="390" height="367" />

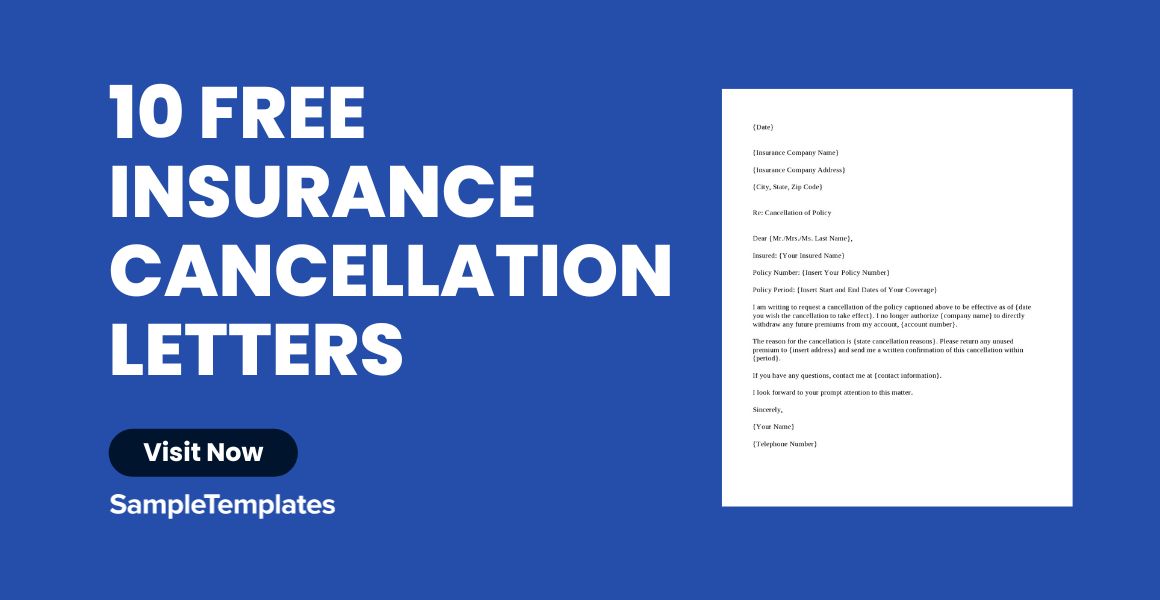

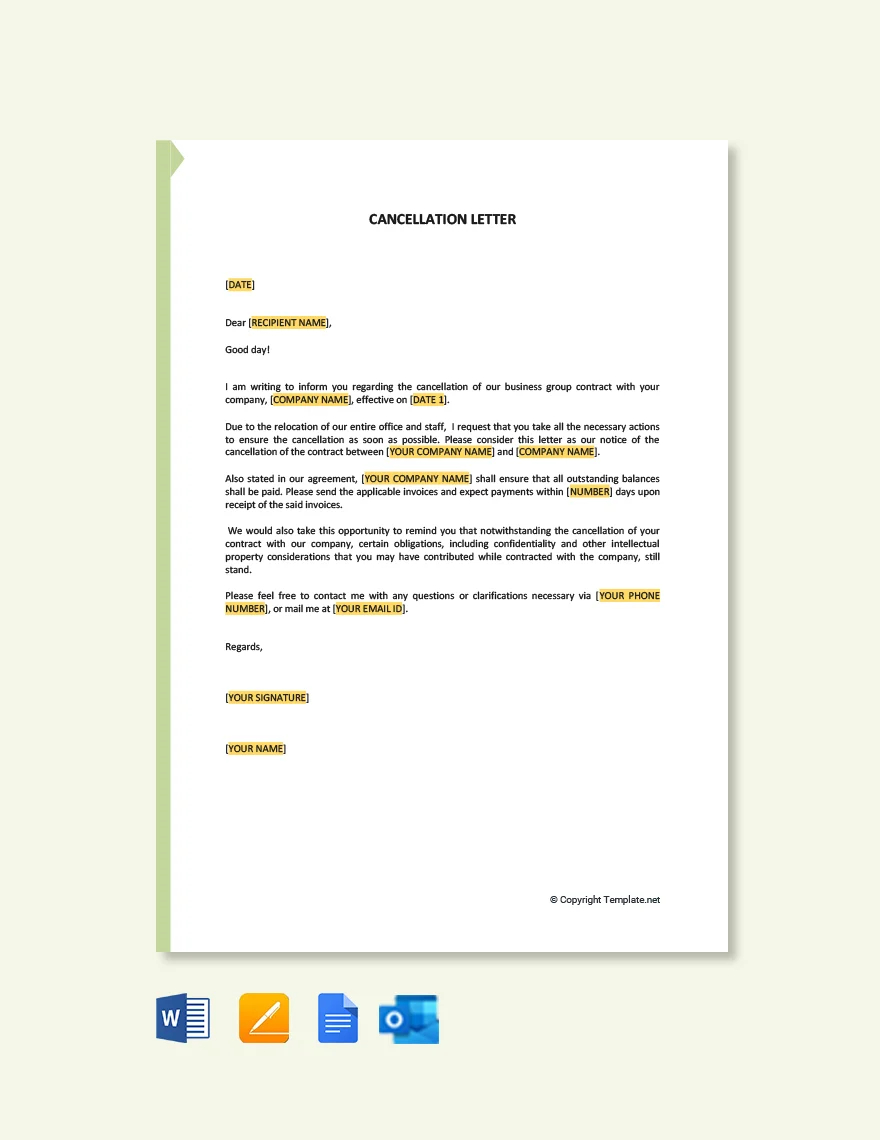

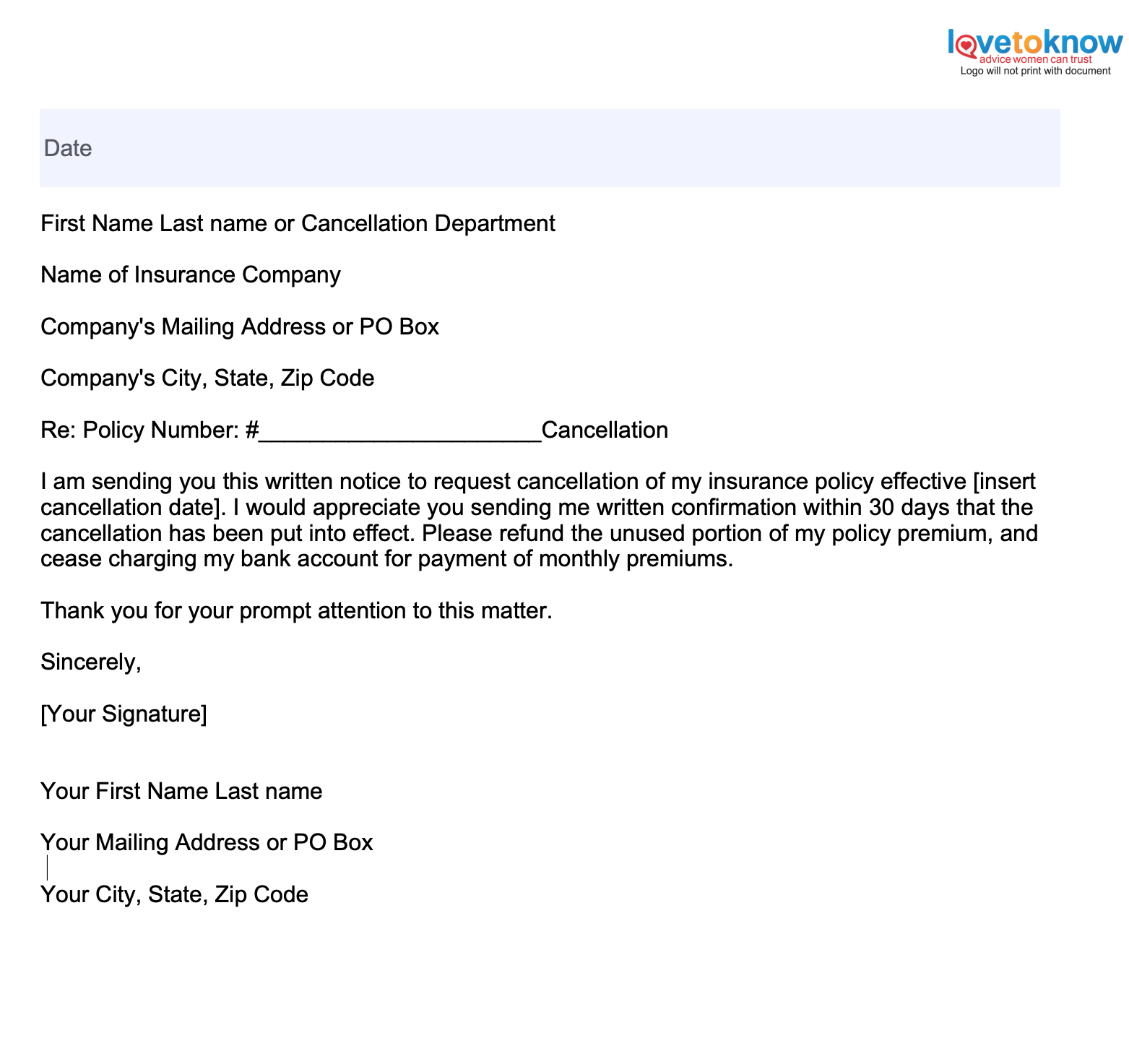

An insurance cancellation letter is a formal notification indicating an individual’s desire to terminate an insurance policy. This document serves as a written record of the policyholder’s decision to end the coverage before the policy’s natural expiration date. It’s a crucial step for anyone who has determined that their current insurance policy no longer aligns with their needs, whether due to changes in circumstances, finding a better rate elsewhere, or any other reason.

The letter should be clear and concise, providing all the necessary details to facilitate a smooth cancellation process. It typically includes the policyholder’s name, the insurance policy number, and the effective date of cancellation. It’s also important to state explicitly that the purpose of the letter is to cancel the insurance policy. This avoids any confusion that might arise from less direct communication.

Moreover, the cancellation letter serves as a formal request letter to the insurance provider for a confirmation of the cancellation and any expected refund of prepaid premiums. This is especially pertinent if the policy is canceled well in advance of its renewal date. Policyholders are often entitled to a refund of some portion of the premium, depending on the terms of the policy.

It’s essential to send the insurance cancellation letter via a method that provides proof of delivery, such as registered mail or email with a read receipt. This proof of delivery ensures that there is a record of the insurance company receiving the letter, which can be important if there is any dispute about the date of cancellation.

In addition to serving as a formal request to terminate the policy, the insurance cancellation letter also acts as a safeguard against any misunderstandings. It can prevent situations where an insurer continues to bill the policyholder or reports nonpayment to credit bureaus, assuming the policy is still active.