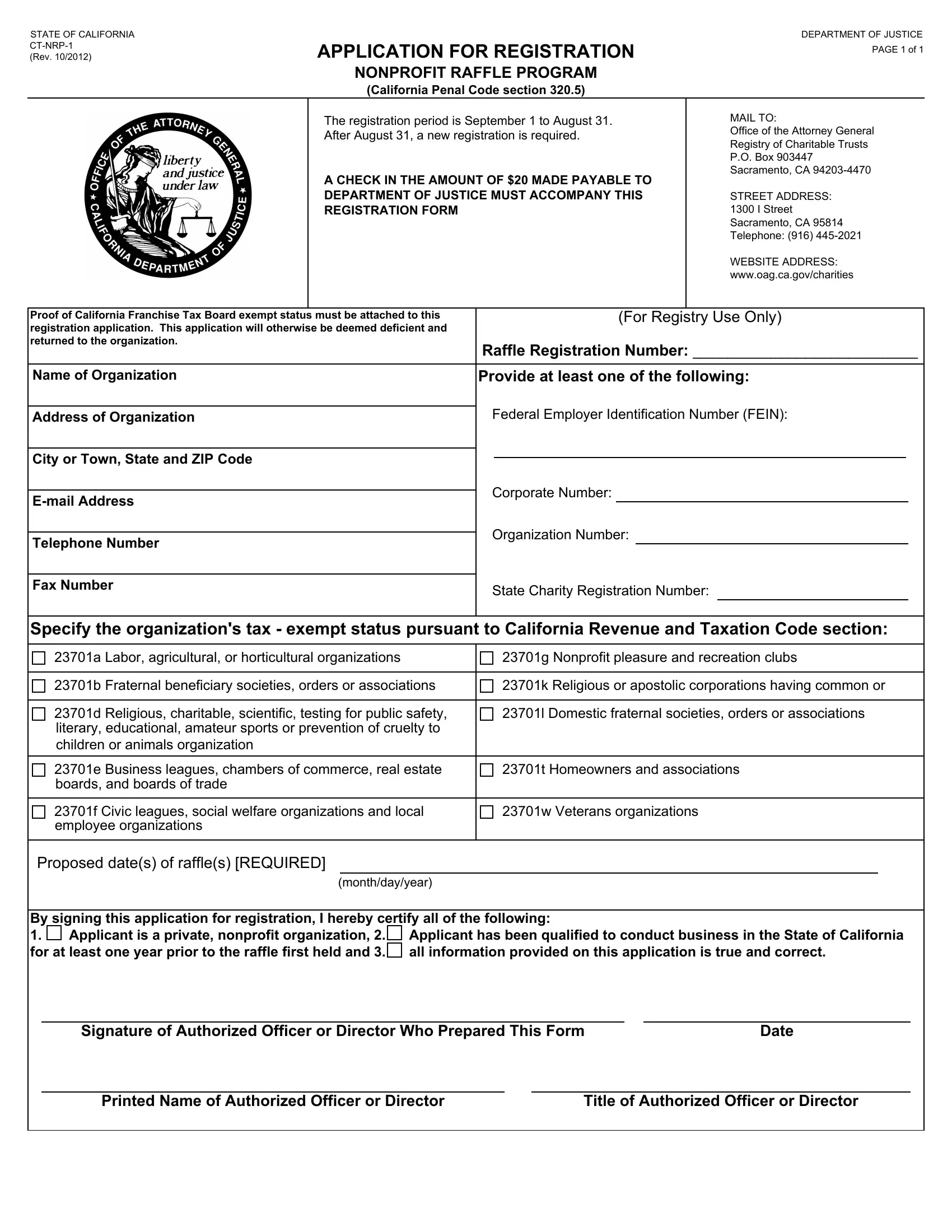

The CT-NRP-1 form is a required document for nonprofit organizations in California intending to conduct raffles, according to the California Penal Code section 320.5. It serves as an application for registration with the Department of Justice's Nonprofit Raffle Program, which operates annually from September 1 to August 31. To ensure compliance and avoid any deficiencies, a proof of exemption status from the California Franchise Tax Board must accompany the submitted application, along with a $20 fee.

For organizations looking to participate in raffle activities, filling out the CT-NRP-1 form accurately is a critical step. Click the button below to start your application process.

Download PDF

In the landscape of charitable activities within the State of California, the CT-NRP-1 form emerges as a pivotal document for nonprofit organizations aspiring to organize raffle programs. Mandated by the California Penal Code section 320.5 and overseen by the Department of Justice, specifically under the Registry of Charitable Trusts, this application for registration codifies the essential steps and prerequisites for legally conducting raffles. The form delineates a registration period running from September 1 to August 31 annually, post which a renewal of registration is requisite. Alongside a $20 fee, payable to the Department of Justice, organizations must furnish proof of exemption status from the California Franchise Tax Board to avoid application rejection due to deficiencies. Critical organizational details such as name, Federal Employer Identification Number (FEIN), address, and various organizational numbers are solicited within the form. It also necessitates disclosure of the organization's tax-exempt status categorized under the California Revenue and Taxation Code, spanning from labor and agricultural organizations to veterans' organizations. Furthermore, it requires specifying the proposed raffle dates, thereby ensuring a structured timeline for raffle events. The form's sanctioning, hinged on the certifying signature of an authorized officer or director, attests to the validity of the provided information and the nonprofit's compliance with state regulations to conduct business in California for at least one year prior to hosting their first raffle. This intricate procedure underscores the state’s efforts to maintain transparency, accountability, and the lawful conduct of raffle activities by nonprofit entities, thereby fostering an environment of trust and goodwill among participants and beneficiaries alike.

| Question | Answer |

|---|---|

| Form Name | Form Ct Nrp 1 |

| Form Length | 1 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 15 sec |

| Other names | oag, 23701k, CALIFORNIA, FEIN |